OUR

CONCEPT

1. Sector Focus.

- Deposit taking SACCOs.

- Non-deposit taking SACCOs.

- Microfinance Institutions.

- Non Financial Cooperatives i.e. Agricultural and Housing Cooperatives..

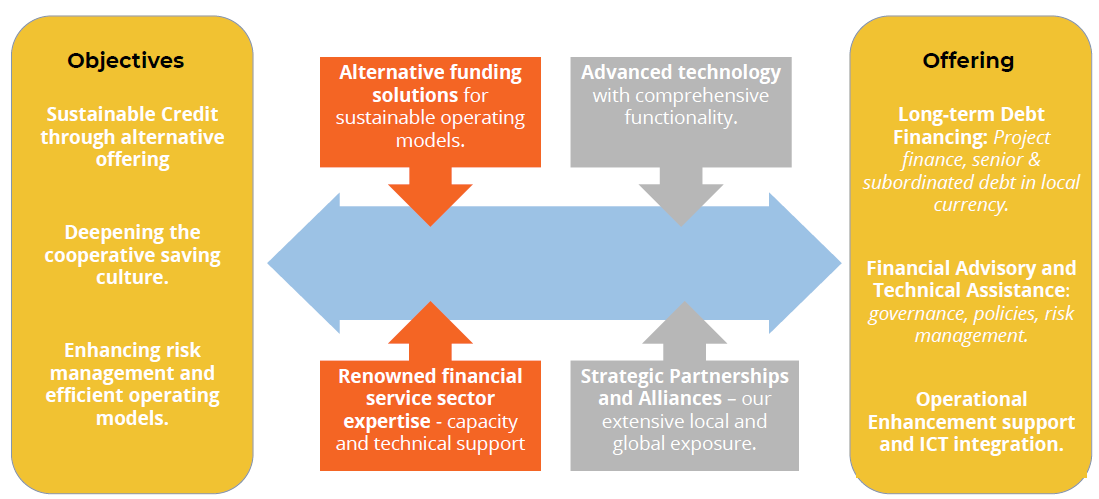

2. Mandate.

- Offer sustainable credit

- Technical assistance on product development, human capital, ICT and system implementation

- Advisory on capital structure, investment management and project development

3. Management.

- Duis management team comprises financial services’ professionals with expertise in Africa’s financial services sector. It is supported by an independent board of directors with vast global experience

BUSINESS

MODEL

OPERATING

STRATEGY

1. Credit Deployment

Informed and prudent credit deployment, fundamental to sustainable credit growth and ultimately attractive investment returns.

2. Operating Principles

Talent, Expertise and Experience

Leveraging on our diverse talents with local and international expertise and extensive experience in financial services.

3. Best Practice

Application and adherence to international best practises.

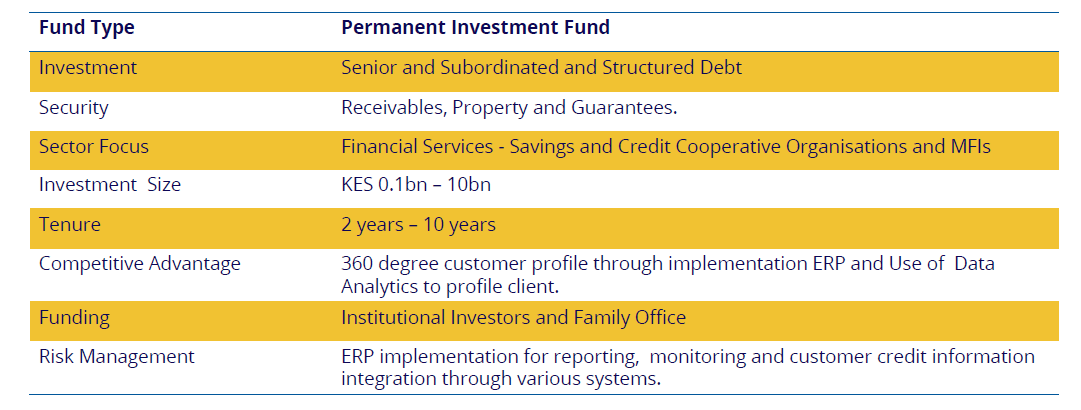

INVESTMENT

STRATEGY

Duis will tailor-make structured and robust credit solutions for its clients, on a longer term basis to support sustainable operations. The basic offering will include:

GOVERNANCE

AND MANAGEMENT

Board Governance Framework.

- Duis Group’s Board of Directors oversee the management and represent the interests of the stakeholders.

- The Board is represented by experienced professionals with a broad professional background.

- The Board should constitute a minimum of 6 and a maximum of 9 members. The Board should comprise a minimum of three independent members offering entrepreneurial, financial service or legal backgrounds, in addition to a maximum of 2 executive members.

- The Board will execute its mandate with the support of key committees: Investment committee, Audit & Risk committee and HR nominations & remuneration committees.

- Key stakeholders will nominate a representation into the Board depending on the seats available.

- Key stakeholders will nominate a representation into the Board depending on the seats available.

Management Framework.

In order to align principal-agent interest and retain key management expertise Duis sets out a highly transparent and objective incentive plan, which aims to enhance the future performance of the company by aligning investor returns to management objectives. The incentive plan will include:

- Employees’ share plan

- Long term incentive plan